Free Fillable South Carolina Power of Attorney Form

Since you are assigning critical powers to another individual, you must exercise extra caution when selecting a private attorney. Ensure that you know the individual on a personal level, for instance, a spouse or relative. As a grantor, choosing an agent is a crucial aspect that will positively or negatively impact your life. Therefore, it is paramount to appoint a reliable and responsible individual to conduct your affairs in case of physical or mental illness. Moreover, a principal can cancel a power of attorney because of many valid reasons.

All POA forms have to follow the state laws and South Carolina POA form also fulfills the regulations. It complies with Title 62, Article 5 Code of Laws of South Carolina. These laws offer protection through specified limitations on the state legislation. It helps the residents to understand the POA creation and the requirements to complete the forms.

Below is an excerpt of the requirements:

- All POA documents must be similar to the South Carolina state forms.

- According to the state laws, the form requires valid signatures, dates, and two credible witnesses.

- All the parties involved must indicate their full names and addresses.

- South Carolina laws state that the private attorney is prohibited from withdrawing life-support treatment for a pregnant grantor.

Why Use a POA Form in South Carolina

Since residents encounter different life circumstances, each person has different reasons for using a South Carolina POA form. Often, most people relate these legal documents to the sick or elderly individuals. Illnesses such as dementia or Alzheimer’s may render one incapable of making proper decisions. That is why a health care power of attorney document can help them get the right treatments through a trusted agent.

Furthermore, people who may get into tragic accidents can end up bedridden for a while. In such situations, creating a power of attorney is the best decision. The individual can’t handle personal or business matters and may need a private attorney to execute various assignments. For instance, paying bills, shopping, or other essential tasks. However, the grantor must ensure that all the powers are clearly stated on the form to avoid confusing the agent during execution.

Since life is quite uncertain, you never know what you might encounter tomorrow. Hence, it is imperative to create a power of attorney forms for different circumstances. Ensure that you understand all the agreements and the requirements according to the state you are residing.

South Carolina Power of Attorney Forms

Below are several types of South Carolina power of attorney forms:

General POA

This form bestows a trusted individual the mandate to manage all the financial matters in place of the grantor. As per South Carolina statutes, the agreement allows the agent to execute all monetary affairs until the grantor dies or suffers incapacitation.

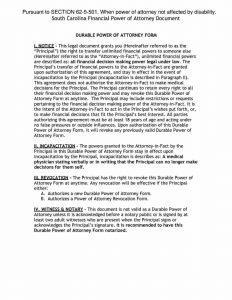

Durable POA

This type of agreement has the same similarities as the general power of attorney. It allows the attorney-in-fact to manage the grantor’s finances. The only difference is that the agreement continues to have power even after the principal gets physical or mental illness.

Limited POA

Sometimes a grantor decides to assign specific powers to an agent to fulfill certain tasks. In such a case, the limited power of attorney is the appropriate form to use. For instance, the agent can manage finances or health care decisions but can’t conduct real estate transactions. This form is also referred to as a special POA.

Guardian of Minor Child POA

Parents who want to travel outside the country and they have minor children can use this form. It allows the grantor to assign legal rights over the child or children to a trusted individual. In such a case, the agent becomes a temporary guardian for the children and makes critical decisions in emergencies.

Health Care POA

When a grantor falls ill and can’t make critical medical decisions, a health care power of attorney will ensure the agent takes responsibility in favor of the grantor. For example, a grantor with dementia can’t give physicians medical consent due to the mental illness. Hence, requiring an attorney-in-fact to make the decisions.

Revocation POA

Suppose a grantor decides to cancel a power of attorney document because of many reasons. In such a situation, the grantor can use a revocation of power of attorney form. It ends the relationship between the principal and the agent.

Real Estate POA

If a grantor wants to issue authority to an agent to manage his/her real estate business, this form will serve the purpose. It allows the attorney-in-fact to carry out various transactions, such as buying, selling, and leasing out properties to customers.

Vehicle POA

When you want to assign an agent authority to execute motor vehicle transactions, you can use the vehicle power of attorney form. The agent will fill and sign all the paperwork from the Motor Vehicle Department of South Carolina in place of the principal.

Tax POA

If the principal cannot conduct taxation duties, he or she can grant powers to an agent to prepare and file taxes to the Revenue Department on time. Usually, the agent should be a professional accountant or an individual with taxation knowledge and skills. According to South Carolina laws, the document is called Form SC-2848.

Other South Carolina Forms By Type

Other Power of Attorney Forms By State

- Alabama power of attorney

- AZ power of attorney form

- California power of attorney form

- Colorado power of attorney

- CT POA

- Florida power of attorney form

- Georgia POA

- Idaho power of attorney

- Illinois POA

- Indiana power of attorney form

- Kansas power of attorney

- Kentucky POA form

- Louisiana power of attorney

- Maryland POA

- Ma power of attorney

- Michigan power of attorney form

- MN POA

- MO power of attorney form

- Nevada power of attorney

- NJ POA form

- NM POAform

- NY power of attorney form

- NC power of attorney

- Ohio power of attorney form

- Oklahoma POA

- Oregon power of attorney pdf

- PA POA

- Tennessee power of attorney

- Texas power of attorney form

- Utah POA

- Virginia power of attorney

- WA POA

- Wisconsin POA form